Customs clearance seems like just another step between international shipping and the product’s arrival at the factory or warehouse.

But anyone who’s experienced the reality of industry knows: it’s not.

In practice, this step has the power to derail inventory turnover, jeopardize international contracts, generate silent demurrage, halt production due to a lack of inputs—in other words, hear the famous “you’re going to shut down the factory”—and erode margins with invisible costs, all while your team tries to guess which channel the IRS has parameterized your shipment.

If your industry imports or exports any type of input, machinery, or finished product, understanding customs clearance is essential to protect your operation and maintain competitiveness.

In this article, you’ll learn:

- What customs clearance is and how it works;

- Where most companies go wrong;

- How much it costs to continue operating in the dark;

- And how to use technology to break out of reactive mode and increase operational control.

What is customs clearance?

Customs clearance is the mandatory process of verifying and releasing goods entering or leaving the country. It involves analyzing documents, checking taxes, paying taxes, and complying with legal requirements by the Federal Revenue Service and other regulatory agencies, such as Anvisa, MAPA, and Ibama.

This process exists in virtually all countries, generally called customs clearance in English-speaking countries. While each nation follows its own specific legislation and requirements, the goal is the same: to ensure that goods cross borders legally and in a regulated manner. Countries such as the United States, Japan, China, Argentina, Pakistan, and members of the European Union also have robust customs clearance systems.

But for industry, this process goes far beyond formality. It determines whether the cargo will be released quickly or whether it will be held up, generating costs and delays.

Imagine a production line awaiting an imported component. A failure in customs clearance, whether in tax classification, documentation, or regulatory compliance, can bring the entire industrial chain to a standstill.

That’s why understanding this process isn’t just the responsibility of the customs broker. It’s strategic for those leading the supply chain, operations, and international logistics.

Also read: Tax Reform: What’s Changing and How Can Your Industry Prepare?

What are the steps involved in customs clearance?

If you think customs clearance begins when the cargo arrives at the port or airport, you’re already late. This process begins well before international shipment.

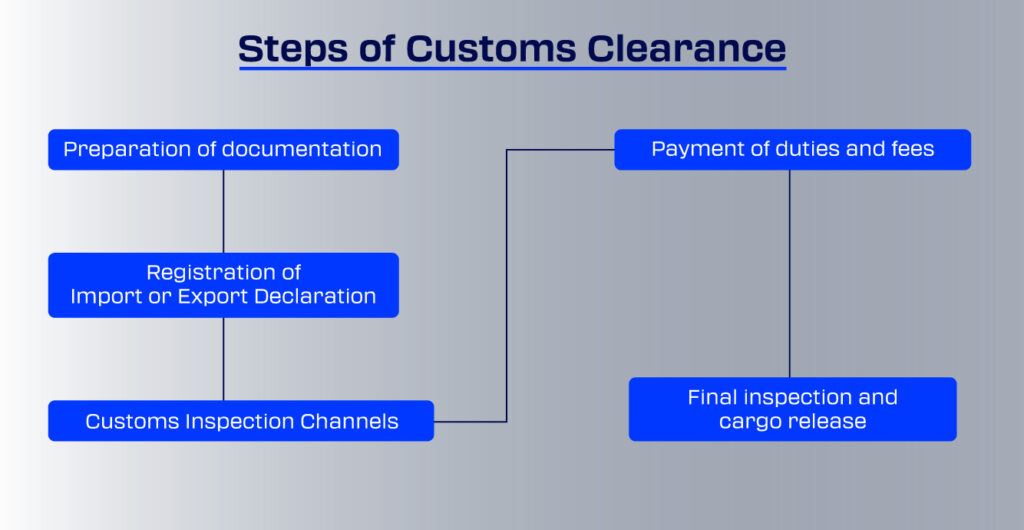

Check out the steps involved in customs clearance:

Documentation Preparation

If there’s one thing no industry can neglect in international trade, it’s documentation preparation. The responsible manager needs to gather mandatory documents with precision.

Below, check out the main documents:

Commercial Invoice

This is the reflection of your international negotiation. It includes the value, product description, exporter data, and serves as the basis for calculating taxes.

Import Declaration (DI)

This is the official digital document for the entry of goods into the country. It centralizes all information about the product, its origin, value, and taxes.

Certificate of Origin

This determines where the goods were produced. This directly affects the tariffs applied and can be decisive in trade agreements.

Bill of Lading (AWB)

This is proof that your cargo has been “shipped” and is in transit. It also serves as a transportation contract and document of ownership.

Other essential documents:

- Packing list: describes the contents, weight, and dimensions of each package, the famous “what’s inside each box”;

- Cargo manifest: general list of goods shipped;

- DUIMP LCPO: despite its new nomenclature, it fulfills a similar function to an import license, with the advantage of integrating controls between the different approving agencies, such as Anvisa, MAPA, Ibama, among others.

Registration of the Import or Export Declaration

This step formalizes the process in Siscomex (Integrated Foreign Trade System), marking the beginning of official tracking of the cargo by Brazilian customs.

The registration must accurately reflect all tax, commercial, and logistical information about the shipment. Any inconsistency can generate additional requirements and delay clearance, the infamous red channel.

Customs Inspection Channels

After registration, the Federal Revenue Service automatically defines, through a risk system, which channel the cargo will be inspected through:

- Green: automatic release

- Yellow: more thorough document analysis

- Red: document analysis + physical inspection

- Gray: suspected fraud — full investigation

The industry has no control over the channel, but can take action to reduce the risk of falling under more stringent parameters.

Payment of Taxes and Fees

For imports, this is where taxes such as II, IPI, PIS, COFINS, ICMS, and others are collected.

For exports, there is generally an exemption from taxes. However, operational fees and requirements from other agencies may still apply. It is worth remembering that, although the government’s official position admits the possibility of taxation, Brazilian exports remain exempt to date.

Final inspection and cargo release

If everything is correct and taxes are paid, the Federal Revenue Service authorizes delivery of the goods, meaning they have been cleared.

This release is the final step in customs clearance—and the beginning of internal transportation to the final destination.

Main bottlenecks in customs clearance that hinder operations

Your industry may have a well-structured internal flow, contracts with reliable suppliers, and precisely scheduled transportation.

But all it takes is one flaw in customs clearance for all of this to fall apart. And the most critical?

Most of the bottlenecks aren’t what you see, but what’s hidden between the lines of documentation, a lack of alignment between departments, and poor process visibility.

The following are the most common bottlenecks that continue to be costly for the industrial sector:

Incomplete or inconsistent documentation

Simple errors such as discrepancies between invoice and contract values, incorrect tax classification, or the absence of specific licenses generate immediate demands.

This triggers rework, delays, and the risk of fines.

Lack of internal alignment

Purchasing, logistics, tax, and foreign trade don’t always follow the same path. Without standardization, inconsistent information is common.

High-Risk Federal Revenue Parameterization

The IRS’s analysis system cross-references historical data, tax profiles, and inconsistencies to determine whether your cargo will be inspected.

The more noise your company generates, the greater the chance of falling into more stringent channels, and each additional channel means more time, physical inspection, and potential for questioning.

Lack of Visibility and Control

Without monitoring systems, the industry discovers the problem too late.

And when managers are held hostage by these situations to obtain information, decision-making becomes a guessing game. The consequence is inertia, reactivity, and difficulty in reorganizing the rest of the operation.

What are the consequences of poorly performed customs clearance?

A poorly conducted customs clearance process is not just a one-off problem. It poses a systemic risk to the entire industrial chain, including tax, accounting, systemic, and strategic issues.

In an environment where deadlines are tight, margins are increasingly pressured, and logistical predictability is crucial, the impacts of failures in this process can be profound and long-lasting.

Below, understand the main consequences that directly affect industrial operations:

Delays in clearance and schedule disruptions

Every day that cargo is held in customs represents a disruption in production planning. When parts, supplies, or products don’t arrive on time, the cascading effect compromises delivery times, increases machine downtime, and forces relocations that impact the entire factory.

Extra storage and demurrage costs

Detained cargo generates storage charges at port and airport terminals. In many cases, the dwell time exceeds the expected, and the cost increases exponentially.

Furthermore, there are situations where demurrage is charged for late container returns.

Fines and Tax Penalties

Errors in import declarations, NCMs, customs values, or tax payments can lead to severe fines from the Federal Revenue Service.

Some violations even prevent cargo removal until they are regularized—further worsening the financial and operational impact.

Loss of Business Opportunities

A delay caused by a failure in customs clearance can compromise delivery, lead to a breach of contract, commercial losses, and, in more severe cases, the permanent loss of a customer.

Damage to the Company’s Image and Reputation

When delays become frequent or logistics costs spiral out of control, the market takes notice. Customers, partners, and even investors see this as a sign of disorganization and a lack of control over critical processes.

A reputation built over years can be damaged by recurring failures at a strategic point in the operation.

Also read: Sin Tax and Tax Reform: Impacts and Strategies for Foreign Trade

5 Steps to Speed Up Customs Clearance

In foreign trade, improvisation is synonymous with loss. And when it comes to customs clearance, each poorly managed step opens the door to delays, fines, and loss of control over the logistics flow.

The good news is that with organization, clear processes, and wise choices, it’s possible to significantly reduce risks and make customs clearance an integrated part of your industrial routine.

Below, we’ve listed five steps to help industries seeking customs efficiency:

Standardize Internal Processes

Create standardized workflows with integrated checklists and cross-validations. This helps reduce source errors and ensures that documents arrive correctly and on time.

Careful Analysis of NCM and Tax Classification

Choosing the wrong NCM is one of the main causes of requirements and fines. The industry must invest time in correctly classifying products and avoiding questions from the Federal Revenue Service.

It is vital that the tax, accounting, finance, control, and engineering departments are aligned with the customs clearance history signed by customs brokers.

Advance Document Validation

It is recommended to review all transaction documents. A prior analysis avoids rework and allows for the correction of inconsistencies before the cargo enters the country.

Strategic Partner Selection

Customs brokers, logistics operators, and freight forwarders should act as extensions of your operations. Prioritize partners with experience in your industry, familiarity with the products being handled, and real-time responsiveness.

Continuous Operations Monitoring

It is not enough to simply “monitor” the process. It is necessary to have indicators, real-time visibility, automatic alerts, and control over the progress of each step. This allows for quick corrective actions.

How can technology simplify customs clearance in industry?

Customs clearance is a complex process. But it can be organized digitally.

Many of the bottlenecks you’ve seen so far stem from a lack of visibility, control, and integration. And that’s exactly where technology comes in: replacing improvisation with data, and rework with operational intelligence.

According to a study by the CNI, 74% of large Brazilian industries that invested in 2023 had technological innovation as their main objective. This number reinforces a clear trend: industrial competitiveness is increasingly linked to the ability to integrate technology into key business processes.

Companies that adopt digital solutions to manage their customs operations gain something valuable: predictability. They know exactly where each shipment is, what stage of the process it is at, and what needs to be done to ensure its timely release.

Besides visibility, technology allows for the automation of tasks that previously required hours of teamwork. NCM checks, report generation, expiration control, deadline alerts, and incomplete documentation are no longer a constant concern. This frees teams to act more strategically, focusing on decisions that truly add value.

Another transformational point is integration. By connecting internal departments and integrating external partners, communication becomes more fluid. What previously took days to clarify can now be resolved in minutes.

More than just speeding up processes, technology brings operational control.

Want to transform customs clearance into a competitive advantage?

While many industries still treat customs clearance as a necessary evil, some already see it as a strategic lever.

With V-Comex, your operation gains full visibility into every step of the process, reduces documentation risks, eliminates communication bottlenecks, and turns clearance time into a productivity ally.

You no longer need to operate in the dark or chase documents at the last minute.

V-COMEX was developed for those who need to keep production running, inventory under control, and customer deadlines on track.

Talk to our experts and see how your operation can evolve intelligently.