Raissa Cardoso | Jornalista | Mestre em Comunicação e Práticas de Consumo

Tax Reform has been one of the most discussed topics in recent months, and for good reason. The proposed changes promise to simplify the system, unify taxes and directly impact companies and consumers.

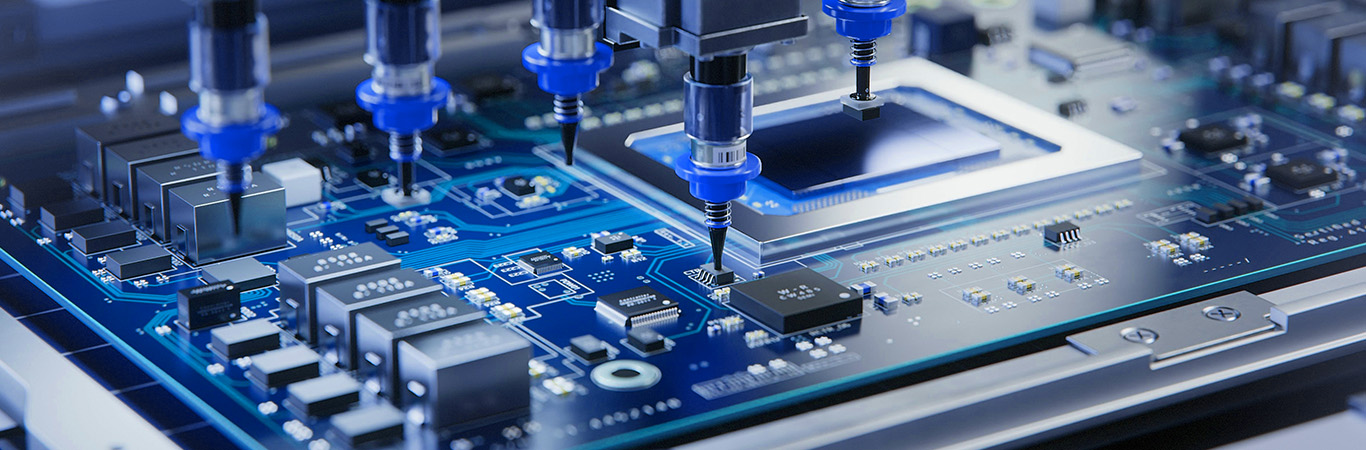

But how will these tax changes impact industries?

In this article, we will explain the main points of the reform, its possible effects on the economy and what your industry needs to know to prepare for this new tax reality.

What is Tax Reform?

Tax Reform is a set of changes to the country’s tax collection system, with the aim of making it simpler and more efficient.

In the case of Brazil, the proposal seeks to correct historical distortions, reduce bureaucracy and improve the business environment, making taxation more transparent and balanced.

Currently, the Brazilian tax system is complex, with several taxes levied at different levels (federal, state and municipal), creating more difficulties for companies and consumers, in addition to making products and services more expensive.

According to KPMG, “the Brazilian tax burden is one of the highest in the world, representing around 33% of GDP. The current model is known for its complexity, with dozens of fees and ancillary obligations, requiring companies to have a robust accounting structure to ensure compliance and avoid penalties”.

What Will Change With Tax Reform?

The new Complementary Law No. 214/2025 was sanctioned on January 16th, and provides detailed rules for implementing the new consumption tax system in Brazil.

The main change will be the unification of taxes to simplify tax collection and make the system more efficient for companies and consumers.

Alexandre Gera, CEO of DigiComex, states that “Tax Reform simplifies everything in every way, promoting the calculation of these taxes and simplifying the consumer’s life, from buying bread to buying a car, for example”.

With the reform, five taxes will be replaced by a Dual VAT, which will be divided into two:

CBS (Contribution on Goods and Services) – administered by the Union, bringing together PIS, Cofins and IPI.

IBS (Tax on Goods and Services) – managed by states and municipalities, unifying ICMS and ISS.

In addition to these two, there will be a Selective Tax (IS), known as the “Sin Tax”, administered by the Union, which aims to discourage the consumption of items and services that are harmful to health and the environment.

The Ministry of Finance states that the Tax Reform has three main objectives: to foster sustainable economic growth, generating employment and income; to reduce social and regional inequalities through a fairer tax system; and to simplify the tax system, maintaining transparency and promoting greater fiscal citizenship.

The reform brings important changes, such as the end of cascading charges, which impacted companies’ costs by taxing inputs and products at different stages of the production chain. See the image below with the changes in the Tax Reform:

According to Deloitte, the Tax Reform will be implemented gradually, following a transition schedule that has already been defined. The process begins in 2026, with a year of testing, during which the CBS will have a rate of 0.9% and the IBS, 0.1%, while the Cofins rate will be reduced by 1%.

In 2027 to 2028, the CBS will come into full effect, replacing the PIS and Cofins. In addition, the IPI rates will be reduced, except for the Manaus Free Trade Zone.

Between 2029 and 2032, the transition from ICMS and ISS to IBS will be done progressively, with a gradual increase in the IBS and a reduction in the rates of the old taxes.

Finally, in 2033, the transition will be completed, eliminating ICMS, ISS and IPI, leaving only the new CBS and IBS taxes in force.

What are the Impacts of Tax Reform on Industries?

The implementation of the reform will bring significant changes to the operations of industries, requiring companies to adapt, which will need to reassess costs, prices and tax strategies. Understanding these impacts will be essential for industries to maintain their competitiveness and take advantage of the opportunities of this new tax scenario.

KPMG explains that the reform “promotes changes in tax collection deadlines and dates, which will require companies to adapt quickly. In sectors such as industry and agribusiness, where tax incentives are very important, it will be necessary to review projects and investments, which represents an additional challenge”.

The Tax Reform will require strategic adaptation on the part of industries, to minimize risks and maximize opportunities. The simplification of taxes and the replacement of current taxes with Dual VAT will directly impact operations, from the issuance of invoices to logistics management.

Below, understand some of the impacts that the reform may have on industries:

| Impact | How can it affect? |

| Issuing invoices | With the unification of taxes, billing systems will need to be adapted to ensure compliance with the new rules |

| Changes in ERP systems | Companies will need to update their management software to keep up with the new tax requirements and ensure an efficient transition |

| End of tax incentives | The extinction of some regional benefits, especially related to ICMS, can generate financial impacts, requiring a restructuring of tax planning |

| Review of contracts between suppliers and customers | With new tax rules, costs and pricing can change, requiring contractual adjustments to avoid negative impacts on the production chain |

| Impacts on logistics and distribution | The new form of tax collection can change competitiveness between states, influencing strategic decisions about the location of distribution centers and logistics routes |

Gera advises industries to be aware of deadlines and to participate in the entire Tax Reform process, as it may be difficult to control this transition.

According to the CEO, “those who do this homework correctly will have predictable taxes in the future and will have a more tangible reduction in costs and time compared to what we have today.”

What are the advantages and disadvantages of tax reform?

With the unification of taxes and changes in collection, industries can benefit from a simpler and more transparent system, but they can also face challenges in adapting and possible cost increases.

To better understand the impacts of this change, it is essential to analyze the main advantages and disadvantages that it will bring to the sector. See below the main advantages and disadvantages that we have listed

Main advantages:

Reduction in the complexity of the bureaucratic system: By unifying taxes and simplifying rates, the tax system will become more accessible and less bureaucratic for industries, allowing for more agile and efficient tax management.

Increased efficiency and competitiveness: With a more transparent tax environment, Brazilian companies will become more attractive to foreign investment, boosting industrial productivity and fostering the creation of new jobs.

Reduction in the tax burden: Lower taxes not only ease the financial burden on companies, but also increase consumers’ purchasing power, stimulating economic activity and promoting a cycle of sustainable growth.

Better strategic planning: Companies will have a clearer view of the taxes to be paid, which will facilitate financial and strategic planning, allowing for more assertive and sustainable decisions for the future of the business.

Main disadvantages:

Challenging transition process: While industries need to adapt to the new rules, they also need to continue to comply with the obligations of the current system. This is a process that takes time until it is fully absorbed by companies.

Unpredictability during the process: Industries may have difficulty projecting the immediate financial impacts, requiring even more careful strategic management, since there may be uncertainty regarding tax obligations.

The process may be more costly: implementing the new rules requires updating accounting and tax management systems, which can be time-consuming and costly.

Leia também: Por que investir em tecnologia na indústria de alimentos e bebidas?

How to Prepare Your Industry’s Logistics for Tax Reform?

It is necessary to prepare for this Tax Reform process. For Alexandre Gera, it is essential to invest in three pillars: technology, process and procedure. In this way, companies not only keep up with the changes of the reform more effectively, but also strengthen their operational structure, becoming better prepared to face challenges and take advantage of new growth opportunities.

Adapting to the new tax rules does not have to be an obstacle to the growth of your industry. With V-Comex, you automate processes, ensure compliance with legislation and maintain full control over your foreign trade and logistics operations.

Our platform was developed to simplify management, reduce bureaucracy and eliminate bottlenecks, making the transition to the new tax system more agile and predictable. With V-Comex, your industry can achieve:

🔹 Automation and tax compliance without complications;

🔹 Greater control and efficiency in industrial logistics;

🔹 More agile processes for strategic decision-making.

Want to know how V-Comex can help in practice? Talk to our experts and see how your industry can adapt to tax changes more efficiently and safely.